Stocks are a great tool to earn a significant amount of income in the long run. There are multiple stocks in the market that can be traded or invested in. The stock market is not only about the financial numbers of the companies that are listed but also has other assets like currencies, futures and options, mutual funds, exchange-traded funds, and commodities. Any individuals who want to enter the market must educate themselves properly. The risks associated with each of the previously mentioned markets are pretty unique.

Table of Contents

How To Master Trading?

It is going to take multiple months and maybe even a few years to gain mastery over trading itself. The stock market is a complicated system where mass psychology plays a defining role. It is not only about the present data but also the forecasted data that is being fed into the market. The same news or development could be taken in different ways by different traders. This distinct analysis is what divides traders into buyers and sellers. At any given point, there exist both buyers and sellers. Both parties have unique perspectives resulting in unique decisions.

Usually, it takes years to get a hold of a particular market and its whereabouts. Trading can be learned in six months, but experience and adaptation must continue. You must keep taking inputs and learn from them. There can be multiple ways to understand how you can perfect the art of trading.

1. Reading

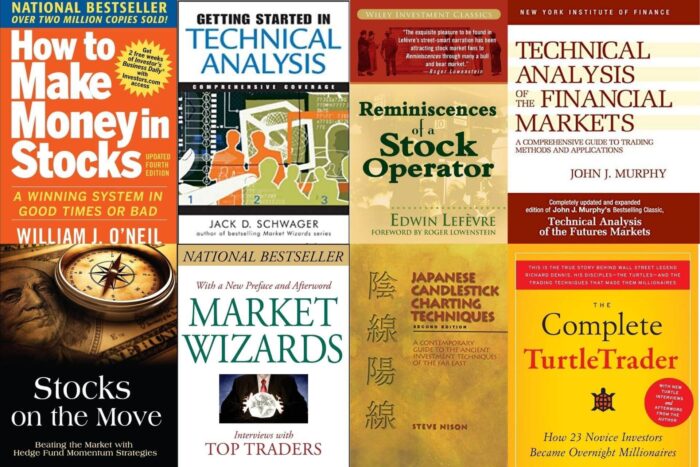

It’s essential to read books if you want to increase your knowledge. The books that educate you about the fundamentals of money management are the ones you should initially invest in. The most crucial idea is money since understanding money is a must for trading any asset, be it currency, crypto, stocks, or commodities.

Books provide in-depth knowledge regarding a variety of market circumstances. Most of its authors have spent their whole careers engaging in trading or investing. Your perspective will undoubtedly be expanded by their thoughts. Understanding how few global happenings each day determine how an asset will perform on the market by reading about the business and how it works can also be beneficial.

2. Taking Courses

Sometimes, it is best to select a course as they can guide you through the process of learning about different markets and basics first. The outline of how a particular market works are the most crucial factor in gaining mastery. Next, it is essential to learn about the various techniques that can be used in the market. Most courses target a particular sector at a time so that you can choose which assets you wish to trade based on your risk appetite. Out of the various markets like cryptocurrency, stocks, and commodities, foreign exchange is one of the most critical markets in lieu of the global impact it has. You can visit this site to avail a forex trading course.

Risk Management In Trading

1. Understanding Risk

All traders desire the high that comes with being wealthy quickly. It will be ideal if you make logical decisions. You could occasionally win a significant amount of money on a wager. It is, however, an exception rather than the rule. Maintain a low profile and act consistently. Over a more significant amount of time, it is nearly difficult to sustain a more significant proportion of green transactions than red ones. If people are not allowed to engage in more than 50% green trades, how do they generate money?

A larger ratio of winning trades to losing trades is not always necessary for a successful trader. Although it looks like a bizarre idea, it is accurate. Maintaining favorable positions while cutting losses allows you to maximize gains.

Let us assume that your risk appetite is $10 per asset unit. Then, aiming for gains with a more excellent value per unit would be the optimal course of action. 1:3 is the ideal risk-to-reward ratio. Accordingly, you lose $10 for every unsuccessful transaction while receiving $30, or three times, for each successful trade. By doing this, you will ensure that even if you wind up with 75 losing transactions out of 100, you will not lose money (excluding taxes and cost of trading).The results of the computation are $30*25 = $750 and $10*75 = $750. The ideal risk to reward ratio for cryptocurrency would be 1:2. The reason behind it is that cryptocurrency moves fast, and trading has to be done on a scalping basis. Scalping is a technique where a position is not held for more than a few minutes.

2. Managing Risk

Risk can be managed and mitigated with the help of specific tools in the market. One such tool is the stop loss order. With a stop loss order, your position will be closed, and you will exit at a specific price level. Typically, the price of this transaction is set below the cost of purchasing the item. For instance, you may set a stop loss at $95 if an asset is purchased for $100. Such a purchase keeps you from experiencing significant losses.

The first thing to keep in mind when establishing a stop loss is that it cannot be placed too close to the price at which you purchased the asset. This advice is given since any stock or asset is subject to modest changes; as a result, you don’t want to abandon a transaction with solid potential at a loss. Certain assets like cryptocurrency fluctuate considerably. They will sharply grow by 10% and sharply decline by 10%. Create the habit of putting a stop-loss order on each occasion you trade to avoid this disaster.

Conclusion

We hardly notice when deals in which we lose money instead of making money instead produce wealth. We will use up our money if one deal results in a loss equal to the profit made on another. Therefore, any trade that is showing a potential profit must be run for long enough to accumulate maximum gains. On the other hand, losses should be cut short with utmost discipline. With proper knowledge, you can easily maintain a positive portfolio in the long run.